dimensionlink.ru Learn

Learn

Azek Stock Forecast

AZEK Company Inc (AZEK) has a Smart Score of 8 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Azek Company Inc (AZEK) ; Volume: 2,, ; Bid/Ask: / ; Day's Range: - Find the latest The AZEK Company Inc. (AZEK) stock quote, history, news and other vital information to help you with your stock trading and investing. The AZEK Company Inc. - Price Target ; , , , , AZEK Share Price Expert Analysis, The AZEK Company Inc. Class A Buy or Sell Recommendations, Forecasts, Comparison and Market Data. AZEK Co has a consensus price target of $ Q. What is the current price for AZEK Co (AZEK)?. A. The stock. The AZEK (AZEK) Stock Forecast & Price Prediction , According to our current AZEK stock forecast, the value of The AZEK shares will rise by % and. Is the Analyst Rating AZEK Co (AZEK) correct? A. While ratings are subjective and will change, the latest AZEK Co (AZEK) rating was a maintained with a price. On further gains, the stock will meet resistance from the long-term Moving Average at $ On a fall, the stock will find some support from the short-term. AZEK Company Inc (AZEK) has a Smart Score of 8 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Azek Company Inc (AZEK) ; Volume: 2,, ; Bid/Ask: / ; Day's Range: - Find the latest The AZEK Company Inc. (AZEK) stock quote, history, news and other vital information to help you with your stock trading and investing. The AZEK Company Inc. - Price Target ; , , , , AZEK Share Price Expert Analysis, The AZEK Company Inc. Class A Buy or Sell Recommendations, Forecasts, Comparison and Market Data. AZEK Co has a consensus price target of $ Q. What is the current price for AZEK Co (AZEK)?. A. The stock. The AZEK (AZEK) Stock Forecast & Price Prediction , According to our current AZEK stock forecast, the value of The AZEK shares will rise by % and. Is the Analyst Rating AZEK Co (AZEK) correct? A. While ratings are subjective and will change, the latest AZEK Co (AZEK) rating was a maintained with a price. On further gains, the stock will meet resistance from the long-term Moving Average at $ On a fall, the stock will find some support from the short-term.

AZEK Company Inc - Ordinary Shares - Class A Stock Forecast, AZEK stock price prediction. Price target in 14 days: USD. Get Azek Company Inc (AZEK:NYSE) real-time stock quotes, news, price and financial information from CNBC. AZEK Company Inc - Ordinary Shares - Class A Stock Price Forecast, "AZEK" Predictons for AZEK is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is forecast. According to analysts, AZEK price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. AZEK ($) is trading above its intrinsic value of $, according to an updated version of Benjamin Graham's Formula from Chapter 11 of "The Intelligent. Discover all the factors affecting Azek's share price. AZEK is currently rated as a High Flyer | Stockopedia. According to 12 Wall Street analysts that have issued a 1 year AZEK price target, the average AZEK price target is $, with the highest AZEK stock price. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. 25 analysts offering month price forecasts for The Azek Company (AZEK) have a share price target of $ This median of share price forecast represents a. Based on short-term price targets offered by 18 analysts, the average price target for The AZEK Company comes to $ The forecasts range from a low of. Stock Price Forecast. The 15 analysts with month price forecasts for The AZEK Company stock have an average target of , with a low estimate of 43 and a. Analyst Forecast. According to 17 analysts, the average rating for AZEK stock is "Buy." The month stock price forecast is $, which is an increase of. AZEK Company Inc - Ordinary Shares - Class A Stock Forecast, AZEK stock price prediction. Price target in 14 days: USD. Research AZEK's (NYSE:AZEK) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. The current price of AZEK is USD — it has increased by % in the past 24 hours. Watch The AZEK Company Inc. stock price performance more closely on the. Azek Company Inc (AZEK) stock is projected to chart a bullish course in , with an average price target of $, representing an $% surge from its. The AZEK Company stock price forecast: $48; Market Cap: B, Enterprise value: B, P/E: , PEG ratio: , EPS: , Revenue: B. AZEK's stock was trading at $ at the beginning of Since then, AZEK shares have increased by % and is now trading at $ View the best growth. Future criteria checks 1/6 AZEK is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum.

How Much Can I Qualify For A House

Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. To be considered for public housing or Section 8 housing, each applicant must complete NYCHA's application here. Beware of Scams - NYCHA does not charge or. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How much house can I afford? · Current combined annual income · Monthly child support payments · Monthly auto payments · Monthly credit card payments · Monthly. Generally, 43% is the highest acceptable ratio a buyer can have and still obtain a Qualified Mortgage (a category of lower risk loans). To assess your ratio. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Keep in mind that just because you qualify for that amount, it does not mean you can afford to be household income. For example, if you annual income. Use this calculator to estimate how much house you can afford with your budget. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. To be considered for public housing or Section 8 housing, each applicant must complete NYCHA's application here. Beware of Scams - NYCHA does not charge or. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How much house can I afford? · Current combined annual income · Monthly child support payments · Monthly auto payments · Monthly credit card payments · Monthly. Generally, 43% is the highest acceptable ratio a buyer can have and still obtain a Qualified Mortgage (a category of lower risk loans). To assess your ratio. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Keep in mind that just because you qualify for that amount, it does not mean you can afford to be household income. For example, if you annual income. Use this calculator to estimate how much house you can afford with your budget.

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. Front-End Ratio – Your monthly mortgage payment should be no more than 28 percent of your pre-tax monthly income. This includes property taxes, homeowners. You can afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. 36% Total Debt Payments - The second part of the rule states that your total debt payments, including housing expenses, should not exceed 36% of your gross. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look at the big picture — your actual take-home pay and. Use PrimeLending’s home affordability calculator to determine how much house you can afford Loans are subject to borrower qualifications, including income. That would be at Maximum a house at $k property with a PITI mortgage of $2,/month for a worker making $60k with no debt. They'd at minimum. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Another clue to examining home affordability is the 28/36 rule. Lenders use this to zero in on what you currently owe and how a mortgage will impact that debt. To be approved for FHA loans, the ratio of front-end to back-end ratio of applicants needs to be better than 31/ In other words, monthly housing costs should. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. You can qualify with a DTI of 50% or even higher in some cases. HomeReady The HomeReady and Home Possible loan programs help income-challenged borrowers. To know how much house you can afford, an affordability calculator can help. Getting pre-approved for a loan can help you find out how much you're qualified to. Working out a monthly household budget (one that includes any additional expenses that come with homeownership) can help tell you how much you should borrow. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. Affordability Calculation Factors. Income. First, add up the income that will be used to qualify for the mortgage, including bonuses and commissions. A simple.

How Much For Netflix Account

How much does Netflix cost? Watch Netflix on your smartphone, tablet, Smart TV, laptop or streaming device, all for one fixed monthly fee. Plans range from. The annual subscription cost for the plan is Rs 7, Netflix Household. Netflix has recently confirmed that it will not allow users to share accounts if they. Plans range from US$ to US$ a month. No extra costs, no contracts. Where can I watch? General ; Netflix Plan, Pricing, Features ; Basic, $/month. Unlimited ad-free movies, TV shows, and mobile games; Watch on 1 supported device at a time. Pricing (US Dollar). Standard with ads*: $ / month. Standard: $ / month (extra member slots** can be added for $ each / month). This plan only costs $ a month, and you get access to almost all the Netflix movies and Netflix TV series. It is in Full HD and you can watch Netflix on two. Basic plan subscribers will now pay $ per month, an increase of $2 per month, and Premium plan subscribers will now pay $ per month, an increase of $3. If you did not see the email, please confirm that the email address associated with your account is correct. Where can I compare Netflix plans and prices? You. No commitments, cancel anytime. Endless entertainment for one low price. Enjoy Netflix on all your devices. Next. Questions? Call How much does Netflix cost? Watch Netflix on your smartphone, tablet, Smart TV, laptop or streaming device, all for one fixed monthly fee. Plans range from. The annual subscription cost for the plan is Rs 7, Netflix Household. Netflix has recently confirmed that it will not allow users to share accounts if they. Plans range from US$ to US$ a month. No extra costs, no contracts. Where can I watch? General ; Netflix Plan, Pricing, Features ; Basic, $/month. Unlimited ad-free movies, TV shows, and mobile games; Watch on 1 supported device at a time. Pricing (US Dollar). Standard with ads*: $ / month. Standard: $ / month (extra member slots** can be added for $ each / month). This plan only costs $ a month, and you get access to almost all the Netflix movies and Netflix TV series. It is in Full HD and you can watch Netflix on two. Basic plan subscribers will now pay $ per month, an increase of $2 per month, and Premium plan subscribers will now pay $ per month, an increase of $3. If you did not see the email, please confirm that the email address associated with your account is correct. Where can I compare Netflix plans and prices? You. No commitments, cancel anytime. Endless entertainment for one low price. Enjoy Netflix on all your devices. Next. Questions? Call

Plans range from $ to $ a month (pre-tax). No extra costs, no contracts. Where can I watch?

I cancelled Netflix almost a year ago and so far I'm not missing anything account there. About 10CAD for a premium plan. Upvote 1. If you did not see the email, please confirm that the email address associated with your account is correct. Where can I compare Netflix plans and prices? You. How much will it cost to share a Netflix account? The streaming giant stated that going forward it will cost U.S. subscribers an additional $ a month to. /month for 2 screens (which means it's a joint account and 2 different users can login with the same credentials, have their own profile and. At a base price of $ a month, Netflix's ad-supported plan delivers a thunderous bang for your subscription buck. Unlike the others that are still trying to. Plans range from $ to $ a month (pre-tax). No extra costs, no contracts. Where can I watch? Redeem or check activation status. Netflix streaming subscription requires redemption, a new or existing active Netflix account, and a compatible streaming. How much does a Netflix subscription cost? · The Standard plan with ads. This costs $ per month and lets you watch on two devices at a time. · The Standard. You can create profiles for members in your household, allowing them to have their own personalized Netflix experience. Your account can have up to five. The annual subscription cost for the plan is Rs 7, Netflix Household. Netflix has recently confirmed that it will not allow users to share accounts if they. Netflix has three plans to choose from: Standard with Ads for $7 per month, Standard for $, and Premium for $ Although $23 is costly compared to other. Get a Netflix subscription at no additional cost included in your phone plan. Netflix on Us offers unlimited access to movies and TV shows on all devices. Netflix is a streaming service with unlimited TV shows, movies, and more. You can watch as much as you want, whenever you want. There's always something new to. While Netflix charges monthly, you can add one or more gift cards to your account to cover more than one month of service. You can purchase as. Reduce how much you pay for your Netflix subscription. It's However you can be an existing Netflix user, and you can link an existing Netflix account. You can create profiles for members in your household, allowing them to have their own personalized Netflix experience. Your account can have up to five. /month for 2 screens (which means it's a joint account and 2 different users can login with the same credentials, have their own profile and. Your billing history, along with the price and applicable taxes for your subscription, can be found in the payment history on your account page. This plan only costs $ a month, and you get access to almost all the Netflix movies and Netflix TV series. It is in Full HD and you can watch Netflix on two. Regardless of the plan, each extra account costs $/month. Diagram showing how Netflix households can add an extra member. Netflix. As such.

How To Never Pay Student Loans

Forgiveness eliminates your debt; forbearance postpones your payments. If you're having trouble making student loan payments, you can ask your lender for. It is possible to be financially responsible with your student loan payments and save money for other things, like a house, retirement, an emergency fund or a. Learn about SAVE, the newest IDR plan, and how to enroll. The SAVE plan is the most affordable student loan repayment plan in history. It may provide you with. How you choose to repay your loan: If you choose a loan that does not require you to make payments while you're in school, interest will keep adding up and will. Avoid Student Loan Scams You never have to pay for help with your student loans! Student loan debt can be overwhelming, particularly if you are struggling to. Check if you're eligible for a student loan deferment, which allows you to temporarily reduce or postpone payments on your student loans in special. Student loan deferment and forbearance If you are having trouble paying back your student loans, you may qualify for: Both give you a temporary pause in. students do not have to repay. But funding levels for the program have not kept pace with the rising cost of college, resulting in more students turning to. Know what you owe. · Stay current and pay on time. · Keep in touch with your lender. · Know your options for paying off student loans. · Never pay money upfront for. Forgiveness eliminates your debt; forbearance postpones your payments. If you're having trouble making student loan payments, you can ask your lender for. It is possible to be financially responsible with your student loan payments and save money for other things, like a house, retirement, an emergency fund or a. Learn about SAVE, the newest IDR plan, and how to enroll. The SAVE plan is the most affordable student loan repayment plan in history. It may provide you with. How you choose to repay your loan: If you choose a loan that does not require you to make payments while you're in school, interest will keep adding up and will. Avoid Student Loan Scams You never have to pay for help with your student loans! Student loan debt can be overwhelming, particularly if you are struggling to. Check if you're eligible for a student loan deferment, which allows you to temporarily reduce or postpone payments on your student loans in special. Student loan deferment and forbearance If you are having trouble paying back your student loans, you may qualify for: Both give you a temporary pause in. students do not have to repay. But funding levels for the program have not kept pace with the rising cost of college, resulting in more students turning to. Know what you owe. · Stay current and pay on time. · Keep in touch with your lender. · Know your options for paying off student loans. · Never pay money upfront for.

Your credit score may drop, and you could be charged high loan collection fees. The Department of Education says a borrower should never pay a company to help. Student loan deferment and forbearance If you are having trouble paying back your student loans, you may qualify for: Both give you a temporary pause in. The financial aid “refund” is not free money. Every $1 you borrow will cost about $2 by the time you repay the debt. If you don't keep your student loan debt in. Scam Alert: MDHEWD is not placing calls to student loan borrowers about a Missouri loan forgiveness program. MDHEWD and the U.S. Department of Education will. An IDR plan customizes your monthly payment to your income. You will never pay more than 10–20% of your discretionary income. Half of borrowers on Fresh Start. For federal student loan borrowers, your options may include switching to an income-driven repayment plan so you have a more affordable monthly payment. Several income-driven repayment (IDR) plans are available to borrowers with Direct Federal loans, Grad Plus loans, and consolidated Direct loans that did not. Know what you owe. · Stay current and pay on time. · Keep in touch with your lender. · Know your options for paying off student loans. · Never pay money upfront for. students do not have to repay. But funding levels for the program have not kept pace with the rising cost of college, resulting in more students turning to. Note that we will never ask for payments via credit cards, gift cards, or cryptocurrency, initiate contact with you offering to pay off/forgive your loan or. If you're seeking Public Service Loan Forgiveness (PSLF) or income-driven repayment forgiveness, in most cases deferment will not allow you to make progress. Another option you can explore is loan forbearance. In forbearance, you receive permission to stop making payments for a set period of time, or your payments. The entire unpaid balance of your loan and any interest you owe becomes immediately due (this is called "acceleration"). · You can no longer receive deferment or. 1. Pay more than the minimum amount due. Perhaps the most obvious, but paying more on your student loans is the most effective way to get rid of them fast. If you're looking for an alternative to student loans, you might hear about income share agreements (ISAs). When you enter an ISA, your school agrees to cover. Make your payments on time · Explore your income-based payment options · Pause your payments in a pinch · Ask for student loan forgiveness · Consolidate your loans. 1. Seek Better Terms from Your Lender. You may be able to apply for some type of debt relief from your lender, whether it's reduced monthly payments or a. student loan payments become a third. Rubin R. I can not afford quality food. Kesha M. Lost jobs in the past and could not pay my loans. I've filed for. Consider making student loan payments during your grace period or while you're still in school, even if you're not required to do so. If you can, try to pay. ISAC urges you to remember to never pay for information about how to pay back your student loans, to learn about your repayment options through the resources.

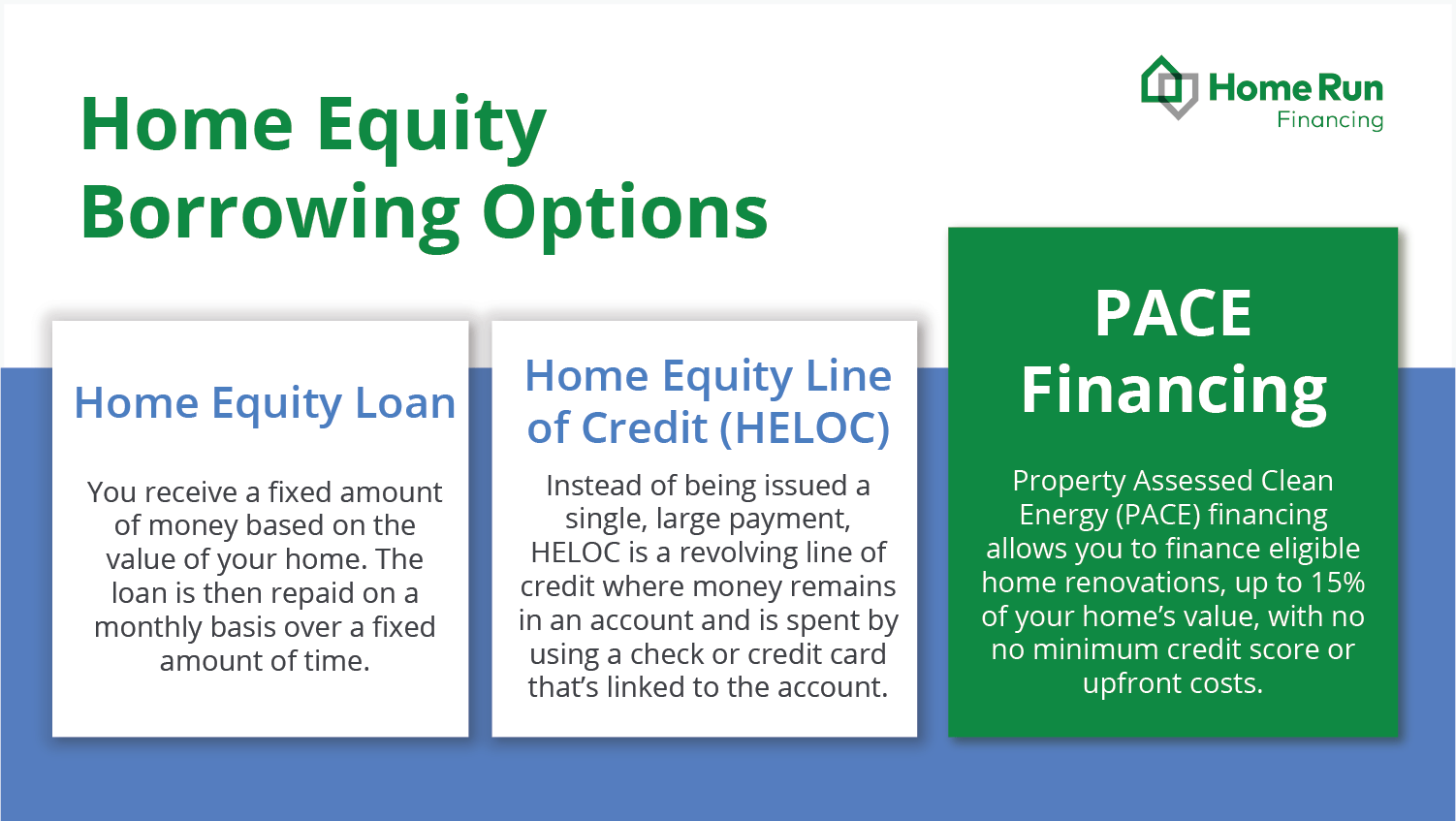

Do I Need Good Credit For A Home Equity Loan

To qualify for a HELOC, you need to have available equity in your home, meaning that the amount you owe on your home must be less than the value of your home. You can find more information from the. Consumer Financial Protection Bureau (CFPB) about home loans at dimensionlink.ru Minimum credit score. You'll need a minimum score, though the most competitive rates typically go to borrowers with scores or higher. Debt-to-income. You'll need decent credit and a low debt-to-income ratio to qualify for a home equity product. If you don't qualify, a cash-out refinance may be an alternative. Minimum qualifications for the introductory rate include 85% maximum combined loan to value and a minimum credit score of Other restrictions may apply. When applying for a home equity loan, you will need to meet the requirements set out by the lender you have selected. You will need a credit score that is high. Lenders typically look at your home equity, your loan-to-value ratio, your debt-to-income ratio, and your credit score before they decide if you qualify for a. Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for. If you live in a state with a U.S. Bank branch, have equity in your home that does not exceed the loan-to-value (LTV) ratio of 80% and have good credit, you may. To qualify for a HELOC, you need to have available equity in your home, meaning that the amount you owe on your home must be less than the value of your home. You can find more information from the. Consumer Financial Protection Bureau (CFPB) about home loans at dimensionlink.ru Minimum credit score. You'll need a minimum score, though the most competitive rates typically go to borrowers with scores or higher. Debt-to-income. You'll need decent credit and a low debt-to-income ratio to qualify for a home equity product. If you don't qualify, a cash-out refinance may be an alternative. Minimum qualifications for the introductory rate include 85% maximum combined loan to value and a minimum credit score of Other restrictions may apply. When applying for a home equity loan, you will need to meet the requirements set out by the lender you have selected. You will need a credit score that is high. Lenders typically look at your home equity, your loan-to-value ratio, your debt-to-income ratio, and your credit score before they decide if you qualify for a. Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for. If you live in a state with a U.S. Bank branch, have equity in your home that does not exceed the loan-to-value (LTV) ratio of 80% and have good credit, you may.

If you have equity built up in your home, you may be eligible for a home equity loan or home equity line of credit (HELOC). · Because home equity loans and. A cosigner is someone with good credit and high income that agrees to pay your debt in case you default on your loan. It also helps to have a large amount of. Credit score: Lenders require a good or better credit score for no doc home equity loans because they're considered higher-risk investments. If you have bad. Both allow you to borrow against the appraised value of your home, providing you with cash when you need it. To qualify for a HELOC, you'll need to provide financial documents, like W-2s and bank statements — these allow the lender to verify your income, assets. Home equity loans are fast and easy to obtain because they do not have credit or income requirements. Most lenders make an instant offer to us based on our. Having a not-so-good credit report could create problems for your plans. If your FICO score falls between and —considered fair by most standards—it could. You can tap into this equity in a few ways, and finance other goals or purchases you may have. Why Use Your Home Equity. If you need to access additional funds. How do I qualify for a HELOC? · Own your home · Have good credit (at most lenders, that means a score no lower than ) · Show proof of income · Have reasonable. Requires a good credit score. Funding in 30+ business days. May charge prepayment penalty fees. What can I do with a home equity loan through Achieve? You can. Credit history. You need to have fairly good credit in order to qualify for most home equity loans. Many lenders will only accept credit scores of or above. However, aside from credit, other significant factors can affect your eligibility for a home equity loan. Answer these questions to know if you can qualify: Do. Most banks and money lending institutions require potential borrowers to have a good credit rating and a stable job before they will consider issuing you a loan. Get a home equity loan approved on equity, with no income or credit requirements. Our equity lenders approve loans up to 85% loan-to-value. Credit history. You need to have fairly good credit in order to qualify for most home equity loans. Many lenders will only accept credit scores of or above. From other lenders, it require good credit history. But at BHM Financial, we base the loan on the value of your home and not on your credit, making our loans a. A higher credit score might lead to better loan terms and interest rates. Other factors, such as the amount of equity you have in your home and overall. It varies by lender, but you'll usually need a credit score in the mid-to highs and a debt-to-income ratio of 43% or less, meaning your total monthly debt. You don't need perfect credit to qualify. Lenders are more concerned about how much equity you have in your home. As long as you have enough equity, you.

How To Know What Cryptocurrency To Buy

A common phrase in the crypto community is 'do your own research' as it's important to understand what you are buying. Investments in crypto can be complex. Buy, transfer, and sell cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and the new PayPal stablecoin, PayPal USD (PYUSD) Discover CryptoSign Up. Look for projects that offer unique features or improvements over existing cryptocurrencies, such as scalability, speed, privacy, or. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC). When a cryptocurrency is minted, created prior to. So if you buy crypto-assets, be prepared to lose everything that you put in. How crypto is used. Cryptocurrencies were first developed as a digital currency to. Top portfolios - Cointree. Discover hidden gems and buy the best performing portfolios from the top traders on our platform in just a few clicks. You can learn. There are many things to consider when choosing the best cryptocurrency to invest in. · Here are four important factors: · Market capitalisation. What to Know Before Investing in Crypto · 1. Does the Crypto Market Close? Timing Is Everything · 2. You Can Buy BTC With Old-Fashioned Money · 3. Watch Out for. Key takeaways · Do you understand the crypto landscape? · Are you comfortable with the volatility? · Can you handle the investment risks? · Do you know how to store. A common phrase in the crypto community is 'do your own research' as it's important to understand what you are buying. Investments in crypto can be complex. Buy, transfer, and sell cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and the new PayPal stablecoin, PayPal USD (PYUSD) Discover CryptoSign Up. Look for projects that offer unique features or improvements over existing cryptocurrencies, such as scalability, speed, privacy, or. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC). When a cryptocurrency is minted, created prior to. So if you buy crypto-assets, be prepared to lose everything that you put in. How crypto is used. Cryptocurrencies were first developed as a digital currency to. Top portfolios - Cointree. Discover hidden gems and buy the best performing portfolios from the top traders on our platform in just a few clicks. You can learn. There are many things to consider when choosing the best cryptocurrency to invest in. · Here are four important factors: · Market capitalisation. What to Know Before Investing in Crypto · 1. Does the Crypto Market Close? Timing Is Everything · 2. You Can Buy BTC With Old-Fashioned Money · 3. Watch Out for. Key takeaways · Do you understand the crypto landscape? · Are you comfortable with the volatility? · Can you handle the investment risks? · Do you know how to store.

Before you buy something with cryptocurrency, know the seller's reputation, by doing some research before you pay. Some information about your transactions. First, you do some research and determine what is the best cryptocurrency to invest in. That's the hard part. You'll analyze price histories, study the. Is Cryptocurrency Money? · Widely accepted means of payment – can cryptocurrencies be used to buy and sell things? · Store of value – can the purchasing power of. There's no way to know for sure which cryptocurrencies will go up in value. However, we can use the laws of supply and demand to better understand how the price. The best way to start is by visiting Coingecko or Coin Market Cap and familiarizing yourself with the front page aka the current top Bitcoin, Ethereum, and other crypto are revolutionizing how we invest, bank, and use money. Learn more in this beginner's guide. CTS · Look before you leap! Before investing in a cryptocurrency, be sure you understand how it works, where it can be used, and how to exchange it. · Use a. Crypto is not regulated like stocks or insured like real money in banks. Crypto's high risks can offer big rewards or huge losses. Knowing how to buy crypto starts with knowing which asset you want to buy or invest in. Many beginner cryptocurrency investors start with established options. Cryptocurrency investors can buy or sell them directly in a spot Bitcoin and CFTC Customer Advisory: Understand the Risk of Virtual Currency Trading. Cryptocurrency is a digital currency using cryptography to secure transactions. Learn about buying cryptocurrency and cryptocurrency scams to look out for. In today's post, we're going to cover the basics of identifying and investing in profitable cryptocurrencies for new investors. Understand what crypto trading is; Learn why people trade cryptos; Pick a cryptocurrency to trade; Open a CFD trading account; Identify a crypto trading. Buying crypto from a centralized crypto exchange · Visit a crypto exchange website. · Create an account and verify your identity as required. · Follow the. You can buy, trade, convert, and swap crypto assets and tokens using Coinbase in a few easy steps. Learn how to purchase crypto assets using our how to buy. But these crypto coins and tokens are a scam that ends up stealing money from the people who buy them. Research online to find out whether a company has issued. Know the merchant's refund, return and dispute policies. Before you make a purchase using crypto assets, find out: what the exchange rate will be; if refunds. Over million users buy, sell, and trade Bitcoin, Ethereum, NFTs and more on dimensionlink.ru Join the World's leading crypto trading platform. First, you do some research and determine what is the best cryptocurrency to invest in. That's the hard part. You'll analyze price histories, study the. Perhaps the most important thing to know is the cryptocurrency-related investment markets are very different than our regulated securities markets. For example.

How Do I Buy Bitcoins With Cash App

In this article, we will explore the steps and considerations involved in acquiring Bitcoin using a credit card through the Cash App. Payment Methods: Buying Bitcoin With a Card · Tap Buy on the dimensionlink.ru App home screen. · Select a cryptocurrency. · Under Cash, select Add Payment Method. Tap the Money tab on your Cash App home screen · Tap the Bitcoin tile · Tap the Airplane button · Choose Send Bitcoin · Enter the amount and the recipient's $. Facilitates customers who want to buy bitcoin with cash or redeem bitcoin for cash The HIM license accelerates interoperability and application development. You can buy bitcoin and a number of other cryptocurrencies at dimensionlink.ru by using the Instant Buy/Sell service. This service is available in our mobile app as well. To buy Bitcoin through your Cash App, simply tap the Bitcoin tab on the home screen, tap "Buy BTC," select or enter an amount, and confirm the. Tap the Investing tab on your Cash App home screen · Select Bitcoin · Select Buy or Sell · Tap the dropdown menu and choose Custom Purchase Order or Custom Sell. The initial weekly purchase limit for Bitcoin on Cash App is $10, This limit is calculated based on the sum of all your Bitcoin purchases. Whether you're new to bitcoin or a seasoned expert, Cash App is an easy and safe way to buy, store, send, and receive bitcoin. BTC. Do I own my bitcoin on Cash. In this article, we will explore the steps and considerations involved in acquiring Bitcoin using a credit card through the Cash App. Payment Methods: Buying Bitcoin With a Card · Tap Buy on the dimensionlink.ru App home screen. · Select a cryptocurrency. · Under Cash, select Add Payment Method. Tap the Money tab on your Cash App home screen · Tap the Bitcoin tile · Tap the Airplane button · Choose Send Bitcoin · Enter the amount and the recipient's $. Facilitates customers who want to buy bitcoin with cash or redeem bitcoin for cash The HIM license accelerates interoperability and application development. You can buy bitcoin and a number of other cryptocurrencies at dimensionlink.ru by using the Instant Buy/Sell service. This service is available in our mobile app as well. To buy Bitcoin through your Cash App, simply tap the Bitcoin tab on the home screen, tap "Buy BTC," select or enter an amount, and confirm the. Tap the Investing tab on your Cash App home screen · Select Bitcoin · Select Buy or Sell · Tap the dropdown menu and choose Custom Purchase Order or Custom Sell. The initial weekly purchase limit for Bitcoin on Cash App is $10, This limit is calculated based on the sum of all your Bitcoin purchases. Whether you're new to bitcoin or a seasoned expert, Cash App is an easy and safe way to buy, store, send, and receive bitcoin. BTC. Do I own my bitcoin on Cash.

In Exodus Mobile, tap the Buy & Sell icon. · a) On the Buy tab, b) select the currency you want to pay with. · Choose a) a payment method and b) a third-party. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Use Apple Pay, Google Pay or your card to buy crypto fast. We also accept PayPal, transfers and wires in certain regions. Sell illustration. Sell. Turn your. Open the Mac App Store to buy and download apps. dimensionlink.ru Crypto DeFi Wallet 4+. Trust Us: Bitcoins. Use Paxful to transform your funds on Cash App to Bitcoin. There are thousands of legitimate offers, choose the best one & start trading today. How to buy BTC with a credit or debit card · Tap Transact on your portfolio screen · Tap 'From' and select 'Credit or Debit cards' · Tap + and enter your card. 1. First and foremost, ensure the completion of your account's authentication process. Once authenticated, proceed with logging into the Cash App. From thereon. We're about to take you on a wild ride, step by step, on how to get your hands on that sweet, sweet Bitcoin using Cash App. When you select Bitcoin, enter the amount you desire and choose the option of paying with a credit card. You will then be redirected to your bank's one-time. 1. Download the Coinme app or visit dimensionlink.ru to create a free account. · 2. Purchase crypto with cash at a participating Coinstar machine using the. Buying Bitcoin on Cash App is easy. All you need to do is make sure that you have a device for the Cash App and then you're ready to buy Bitcoin. You can deposit up to $ worth of bitcoin in any 7-day period. It can be done with these very simple steps. The four main ways to buy Bitcoin Cash are through cryptocurrency wallet apps like the dimensionlink.ru Wallet app app, through brokerages like eToro. Deposit BTC into your CashApp wallet · Launch the app on your smart device, and go through the steps to get to the Bitcoin wallet screen. · Select the option to. About this app. arrow_forward. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the. You can deposit up to $ worth of bitcoin in any 7-day period. It can be done with these very simple steps. Is Cash App a decent option to buy Bitcoin? Loved Strike but my bank doesn't use Plaid verification so looking for a different method to purchase some sats. On dimensionlink.ru, click the Buy panel to search and select Bitcoin Cash. On the Coinbase mobile app, search for Bitcoin Cash by typing “Bitcoin Cash” into the. Buy online or in the BitPay app. 1. Enter an Amount. Enter the amount of Bitcoin Cash you'd like to buy. Enter an Amount. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as.

Reasonable Interest Rate For Personal Loan

1. A good credit score. Getting the best rate on a personal loan is no secret — the higher your credit score, the more likely you are to get a better interest. Generally, the interest rate on an unsecured loan will be higher than a secured loan because there is greater risk involved (no collateral associated with the. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ interest rate than most other banks. You can use the money Increase the value of your home with this unique loan offering competitive interest rates. Personal Loans interest rate starting at % p.a. Avail an unsecured loan at EMI as low as Rs / lakh at the lowest personal loan interest rate at. The current personal loan interest rate prevailing in the market ranges between % and 24% per annum. · While commercial lenders charge a. Update your details below to find the best rate available on a personal loan that meets your needs. ; Kabbage. % with flat monthly fee, 6 or 12 months ; SoFi®. Average personal loan interest rates by credit score ; and above. %. % ; to %. % ; to %. % ; to %. Best personal loan lenders · SoFi: Best overall · Upgrade: Best for fair credit · Discover: Best for no origination fees and low rates · Universal Credit: Best debt. 1. A good credit score. Getting the best rate on a personal loan is no secret — the higher your credit score, the more likely you are to get a better interest. Generally, the interest rate on an unsecured loan will be higher than a secured loan because there is greater risk involved (no collateral associated with the. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ interest rate than most other banks. You can use the money Increase the value of your home with this unique loan offering competitive interest rates. Personal Loans interest rate starting at % p.a. Avail an unsecured loan at EMI as low as Rs / lakh at the lowest personal loan interest rate at. The current personal loan interest rate prevailing in the market ranges between % and 24% per annum. · While commercial lenders charge a. Update your details below to find the best rate available on a personal loan that meets your needs. ; Kabbage. % with flat monthly fee, 6 or 12 months ; SoFi®. Average personal loan interest rates by credit score ; and above. %. % ; to %. % ; to %. % ; to %. Best personal loan lenders · SoFi: Best overall · Upgrade: Best for fair credit · Discover: Best for no origination fees and low rates · Universal Credit: Best debt.

While lower-rate personal loans do exist, SoFi is the most affordable lender offering a good blend of options plus some nice extras. Your interest rate is the percentage you'll pay to borrow the loan amount. Borrowers with strong credit may be eligible for a lender's lowest rates, while. Generally, the interest rate on an unsecured loan will be higher than a secured loan because there is greater risk involved (no collateral associated with the. Qualified clients using Rocket Loans will see loan options for 36 or 60 month term, and APR ranges from a minimum of % (rate with autopay discount) to a. Bottom line. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best. to find a personal loan with a reasonable interest rate. If your credit MembersAlliance Credit Union offers personal loans with competitive interest rates. interest debts and allowing you to pay them off at a more reasonable rate. interest rates than an unsecured loan. Midland States Bank offers loan. Best low-interest personal loans ; Best for discounts. SoFi · % to % ; Best for building credit. Upgrade · % to % ; Best for thin credit. Upstart. If you have a bad credit score, then you may want to look at the higher end of the average APR spectrum to see what kind of rates you may qualify for, if you. Subject to the provisions of sections to , any bank may contract for and receive, on any personal loan, charges at a rate not exceeding nineteen. Interest rates on personal loans are expressed as a percentage of the principal—the amount you borrow. The average personal loan interest rate is dependent on several factors, including the amount borrowed, credit history, and income, among others. What Interest Rate to Expect on a Personal Loan Personal loan APRs typically run from 4% to 36%, but the average rate depends on the loan length and amount. As far as personal loans go, % is generally a pretty great rate and very close to the lowest one can get. Reply. ICICI Bank offers one of the lowest interest rate Personal Loans with a competitive interest rate at %* p.a.. APPLY PERSONAL LOAN. Current rate range is % to % APR. Excellent credit and up to a three-year term are required to qualify for lowest rates. Early Check Advance® loans are affordable alternatives to high-cost payday loans. FCU members can receive paycheck advances of up to $ at reasonable interest. Representative Example: For example, if you receive a $10, loan with a month term and a % APR (which includes a % yearly interest rate and a. A good personal loan interest rate is one that's lower than the national average, which is %, according to the most recently available Experian data. How do. Tangerine Personal Loan (Fixed Interest Rate, Unsecured) Agreement effective September 22, interest, for the sole purpose of recovering costs reasonably.

Where And How To Donate Plasma

Donate Plasma for money, because plasma is such a valuable asset in the medical world, Olgam Life offers financial reimbursement at our plasma donation. Donation Checklist · You're in good health. · You weigh lbs. or more. · You're between 18 – 70 years of age. · You reside within a mile radius from our. Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. Donate blood, donate plasma or donate platelets at a blood donation center near you or a blood drive near you. Make an appointment to donate blood today. An apheresis donation is a targeted way of responding to the demand for plasma, which is growing rapidly. This procedure collects twice as large a volume of. New Plasma Donors Can Earn Over $ During the First 35 Days! In addition to getting paid for each plasma donation, you can make even more money during special. Welcome. Patients all over the world rely on plasma protein therapies to treat rare, chronic diseases. These individuals rely on the generosity and commitment. The Red Cross urges people with type AB blood to consider a plasma donation. AB is the only universal plasma and can be given to patients of any blood type. Donate Plasma for money, because plasma is such a valuable asset in the medical world, Olgam Life offers financial reimbursement at our plasma donation. Donation Checklist · You're in good health. · You weigh lbs. or more. · You're between 18 – 70 years of age. · You reside within a mile radius from our. Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. Donate blood, donate plasma or donate platelets at a blood donation center near you or a blood drive near you. Make an appointment to donate blood today. An apheresis donation is a targeted way of responding to the demand for plasma, which is growing rapidly. This procedure collects twice as large a volume of. New Plasma Donors Can Earn Over $ During the First 35 Days! In addition to getting paid for each plasma donation, you can make even more money during special. Welcome. Patients all over the world rely on plasma protein therapies to treat rare, chronic diseases. These individuals rely on the generosity and commitment. The Red Cross urges people with type AB blood to consider a plasma donation. AB is the only universal plasma and can be given to patients of any blood type.

Find the nearest Red Cross blood, platelet or plasma donation center. Make a difference in someone's life, give the gift of life. Plasma donations in Everett WA. Allergic & autoimmune donors needed. Apply today to be screened for program. Eligible donors earn up to $ per donation. Donating PlasmaPlasma is the liquid portion of the blood that carries clotting factors and proteins. Plasma is needed to treat burn victims, trauma patients. You earn money for your time spent donating plasma at LFB Plasma donors can donate two times a week. For specific compensation information, please get in touch. Learn how to donate plasma for the first time. Find more about CSL's donor-focused plasma donation process, qualifications, and how to get compensated. Am I eligible? · Plasma donors should be at least 18 years old · Plasma donors should weigh at least pounds or 50 kilograms · Must pass a medical. Make a difference. Donate plasma today and help save and improve the quality of life for thousands of people. To make your plasma donation appointment, go to dimensionlink.ru and select Plasmapheresis as your donation type, or call Plasma donor centres. You can donate plasma in our 3 plasma donor centres in Birmingham, Reading and Twickenham. Select a plasma donor centre below to find out. At the paid centres, you can donate twice a week. There is tiered compensation based on plasma volume and donation frequency, starting at $ The need for plasma and plasma donors is more urgent than ever before. Visit dimensionlink.ru to learn more and to find a donation center near you. Generally, plasma donors must be 18 years of age and weigh at least pounds (50kg). All individuals must pass two separate medical examinations, a medical. Apheresis collection of plasma and platelets allows you to donate more frequently than does whole blood donation because the body replaces platelets and plasma. Donating plasma takes just over an hour, including some safety checks beforehand. This page explains what to expect on the day and how to prepare for your. Giving = Living. Save lives by giving plasma. For a donation center close to you, use the location finder. Plasma helps patients with massive blood loss, which can be caused by injuries sustained in serious motor vehicle accidents, childbirth complications and. Why is it Important? givingplasma logo full. The need for plasma and plasma donors is more urgent. PlasmaSource is a full-service plasma donation center in Aurora, IL. We are dedicated to delivering a welcoming end-to-end donation experience. Grifols Plasma has united some of the best plasma donation centers in the industry under our Grifols network, allowing you to donate plasma across the. What is Plasma? · Composed of 90% water, plasma is a transporting medium for cells and a variety of substances vital to the human body. · Plasma carries out a.

Quick Home Equity Line Of Credit

A home equity line of credit (also called a HELOC) is an open revolving form of credit that's secured by the paid value of your home. A home equity line of credit, or a HELOC, is another financial bank product which allows you to borrow against your home's equity. Unlike a home equity loan. Better Mortgage has a One Day HELOC™ program allows you to apply online and get approved within 24 hours. You'll then get your cash within seven days. To get a. Get a home equity loan approved on equity, with no income or credit requirements. Our equity lenders approve loans up to 85% loan-to-value. A home equity line of credit, or HELOC, is a second mortgage that uses your home as collateral to let you borrow up to a certain amount over time. Quick cash. A traditional HELOC takes days. Ours? Only 5 to 10 days! 5. With HELOCs you can borrow funds over time as needed. They also offer flexible repayment options, including interest-only payments for those who qualify. With competitive rates, low fees, and a quick funding process, you'll save time and money with an Advantis home equity line of credit (HELOC). Get the cash you need without leaving home. Apply with our % online application in minutes and with funding in as few as 5 days. A home equity line of credit (also called a HELOC) is an open revolving form of credit that's secured by the paid value of your home. A home equity line of credit, or a HELOC, is another financial bank product which allows you to borrow against your home's equity. Unlike a home equity loan. Better Mortgage has a One Day HELOC™ program allows you to apply online and get approved within 24 hours. You'll then get your cash within seven days. To get a. Get a home equity loan approved on equity, with no income or credit requirements. Our equity lenders approve loans up to 85% loan-to-value. A home equity line of credit, or HELOC, is a second mortgage that uses your home as collateral to let you borrow up to a certain amount over time. Quick cash. A traditional HELOC takes days. Ours? Only 5 to 10 days! 5. With HELOCs you can borrow funds over time as needed. They also offer flexible repayment options, including interest-only payments for those who qualify. With competitive rates, low fees, and a quick funding process, you'll save time and money with an Advantis home equity line of credit (HELOC). Get the cash you need without leaving home. Apply with our % online application in minutes and with funding in as few as 5 days.

A home equity line of credit is a form of revolving credit that is secured by your home. It provides you with the flexibility of accessing the funds that you. A Home Equity Line of Credit (HELOC), sometimes referred to as a second mortgage, is a revolving line of credit that can be used in case of emergencies, short. A home equity loan is a one-time lump sum of money that slowly gets paid back monthly with a fixed interest rate, while a HELOC provides you with access to. Unlike the traditional lending system where your income and credit will limit you on the amount you can borrow, home equity loans offer you the ability to. The simplest way to turn your home equity into flexible funds. See your interest rate and credit limit in minutes, with no impact on your credit score. You need to have your mortgage with Cambrian to qualify for our Home Equity Line of Credit. Simplify your life with credit that's available when you need it. At its core, a home equity line of credit in Canada is a flexible loan that lets you borrow money using the equity you've built up in your home as. Home equity lines of credit usually have better interest rates and more flexible repayment terms than any other loan type. Unlike traditional loans, funds are. The biggest benefit of a Home Equity Line-of-Credit? Flexibility, and more! It could be fast access to funds when you need them. It could be KEMBA Financial. Home equity loans are a great way for homeowners to take advantage of the equity they have built up in their homes. Close in five minutes and get funds in five days with our fast home equity loan, CCM Equity Express, so you can tap into home equity to pay off debt or. Unlock Your Offer. Review your estimated available equity and rates in minutes - all with no impact to your credit score. Fast access to funds. Use your home's equity to finance everything from home renovations, wedding, college tuition or even consolidate your debt—all with a rate 2⁄3 lower than most. Best home equity line of credit (HELOC) lenders in September · Bethpage Federal Credit Union: Best home equity line of credit with a fixed-rate option · BMO. Home Equity Line of Credit (HELOC) · Loan amounts from $10, to $, · Borrow up to % of your homes' equity · Low variable rates starting as low as prime. Introductory rate of % APR on new Home Equity Lines of Credit for 6 months then as low as % variable APR · The amount you can borrow is based on the. Sometimes, life throws curveballs! If you occasionally need extra money for recurring payments or unexpected larger expenses, or would like to have quick. HELOCs allow for quick access to the funds from your home's equity. Pay for home improvements, school, a car, etc with this flexible line of credit. HELOCs allow for quick access to the funds from your home's equity. Pay for home improvements, school, a car, etc with this flexible line of credit. PenFed HELOC Express provides all the advantages of a HELOC — even faster! Close in as little as 15 days1; Fast access to your available equity; Access your.